Published as Aus dem Moore, N., P. Großkurth and M. Themann (2019). Multinational Corporations and the EU Emissions Trading System: The Specter of Asset Erosion and Creeping Deindustrialization. The Journal of Environmental Economics and Management 94, 1-26.

If anyone asked me what the single most important lesson was that I learned from my PhD it would be this: if the question is not important then the answer doesn’t matter. I’m sure Nils and Michael would agree.

Condensed to its essence the result of the paper is this: Very much in line with the extant empirical literature, we find that until now, claims of a substantial industrial relocation caused by the EU ETS that would manifest itself in the erosion of European assets and, consequentially, emissions leakage, seem to be overstated.

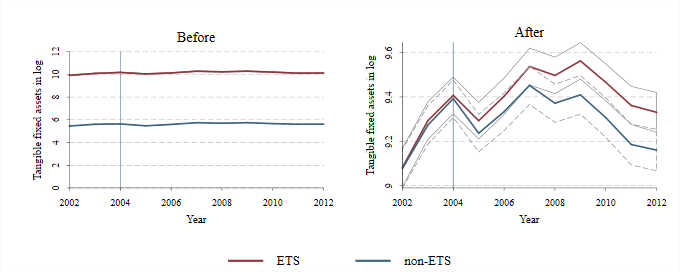

In fact, Tangible Fixed Assets (in log) between treatment and control group follow differing paths after the introduction of the EU ETS in 2005. The paper uses propensity score balancing to ensure the similarity of treatment and control group, employs a wide range of robustness checks and discusses both the assumptions and the more nuanced findings in detail.

Abstract:

This study seeks to investigate the causal effect of the EU Emissions Trading System (EU ETS) on firms’ holdings of fixed assets as an early indicator of industrial relocation, exploiting installation level inclusion criteria of the regulation. To single out companies with particularly low relocation costs, global multinational enterprises (MNEs), we identify ownership structures for the full sample of EU ETS-firms. Matched Difference-in-Differences estimates provide robust evidence that contradicts the specter of an erosion of European asset bases. Baseline results for the manufacturing sector indicate that the EU ETS led to an on average increase of treated firms’ asset bases of 12,1%. However, for a particular subgroup of MNEs, this increase is a mere 2.1%. For these companies, the EU ETS may have induced a shift in investment priorities.