Published as Großkurth, P. (2019b) Dynamic Structure – Dynamic Results? Re-estimating Profit Shifting with Historical Ownership Data. Ruhr Economic Papers 811, RWI 6/2019.

The second important lesson that I learned from my PhD was that one should prioritize based on expectations. In practice that means two things. On the positive side, on should invest time into projects that have a large expected payoff (with is often the case for projects with a rather low probability of success, the “moon shots”). On the negative side this means making damn sure that a crucial assumption that holds the entire paper together does not fail easily. Or that a problem with potentially massive repercussions gets investigated with priority.

The second paper of my dissertation digs into the details of the “constant ownership assumption”, which is made by many empirical papers on MNE. Although it’s neither likely nor convincing to assume that business structures don’t change over time, making this heroic assumption is a great deal easier than working through the alternatives. Many researchers simply did not have access to the necessary data to do it in any other way either. Fortunately (or unfortunately, looking back at my own publication output) I did have access to this data. The main problem can be seen in the following figure:

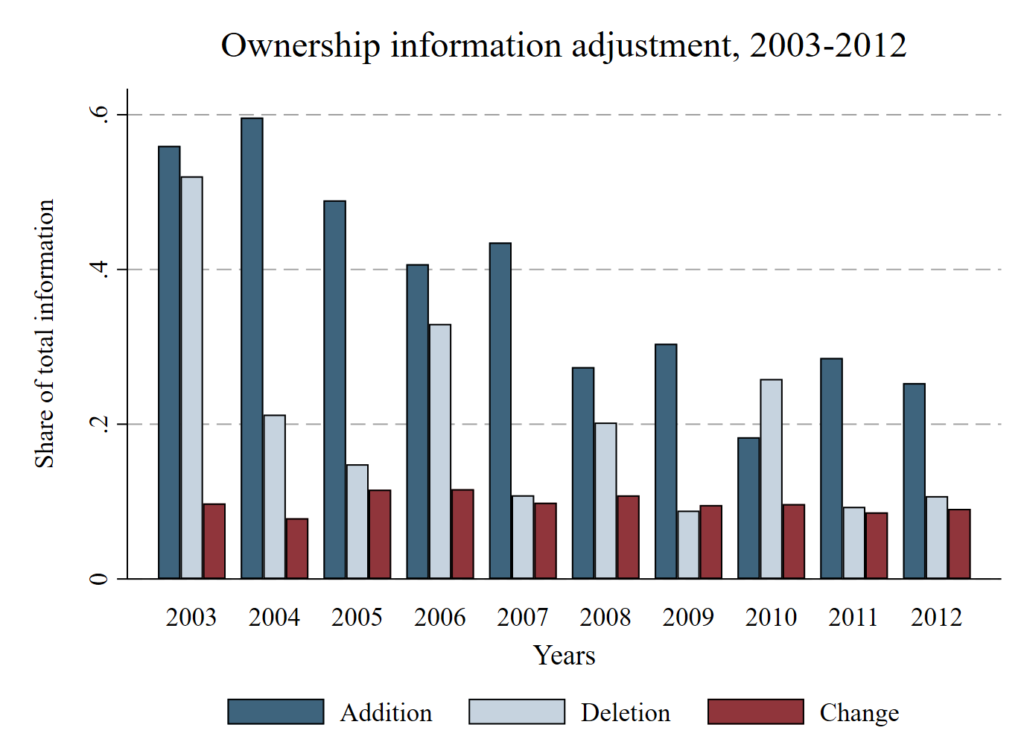

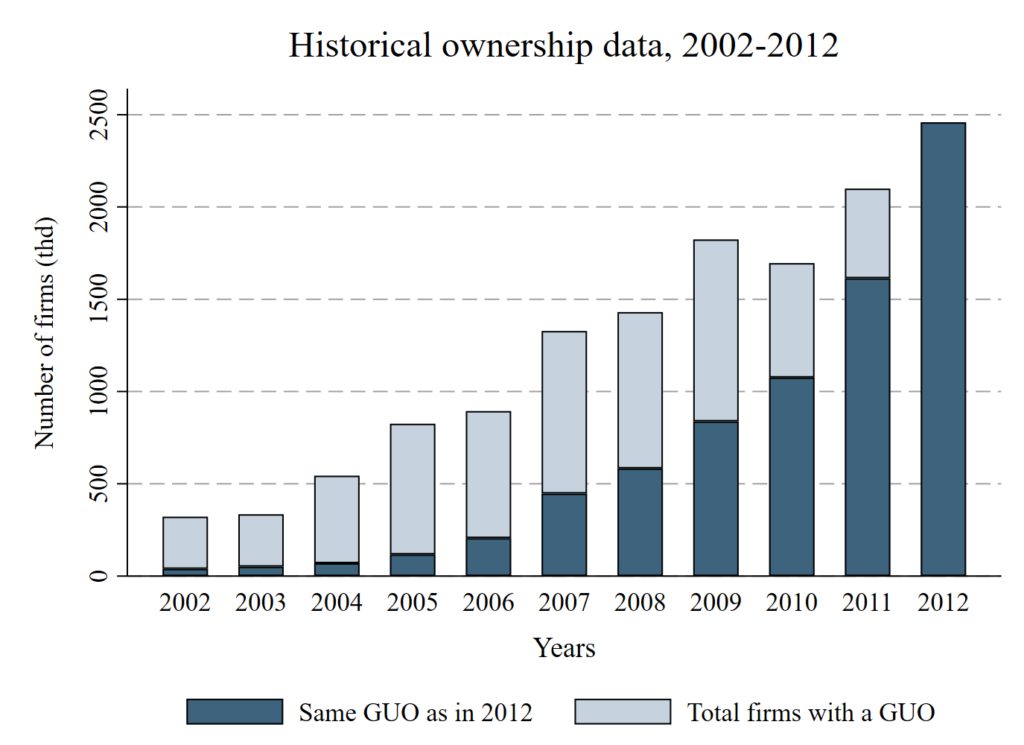

The structural data is nowhere near constant. It changes in every year at an average rate of around 9 percent. As one would expect. For the panel this means that the share of data that fulfills the assumption of constant ownership is practically nonexistent in later years:

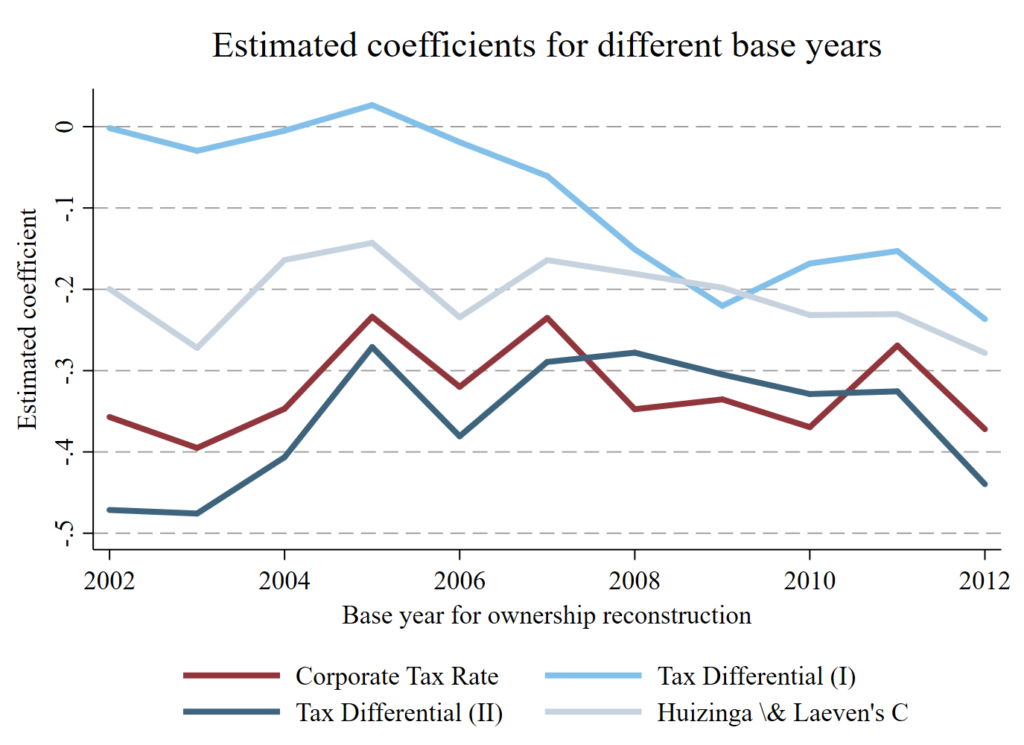

What does this mean in practice? I investigated some simple estimations of profit-shifting and found that the coefficients can change if the underlying sample is changed based on the ownership data structure.

Future research on MNE could benefit from additional robustness checks that take varying ownership structures into account, because this effect might be of different relevance for different questions. As can be seen above, different indirect measures of profit shifting have different sensitivities to changes of the structural data. This could be a problem in other studies, but does not have to be.

What is a problem is that this was the first paper to check an assumption that an entire stream of the literature is built upon.

Abstract:

Ownership structures of multinational enterprises are commonly assumed to remain constant over time, both due to a lack of easily accessible panel data and to facilitate empirical analyses. This paper discusses the validity of this assumption and assesses its relevance in the context of profit shifting. A new method of reconstructing historical ownership information in Bureau van Dijk’s ORBIS database reveals a highly dynamic environment. The validity of the assumption collapses with increasing panel length; ownership structures are rarely constant over time. Moreover, about 9 percent of firms with observed ownership data change owners in each year. The relevance of the assumption is tested by re-estimating indirect measures of profit shifting for selected benchmark samples. Assuming ownership structures as constant has a strong impact on sample composition, adding almost 29 percent of additional observations compared to historical ownership data. In the context of profit shifting, estimates based on constant ownership data are found to be larger in absolute magnitude compared to estimates based on historical ownership data.